Calculate fica and medicare withholding

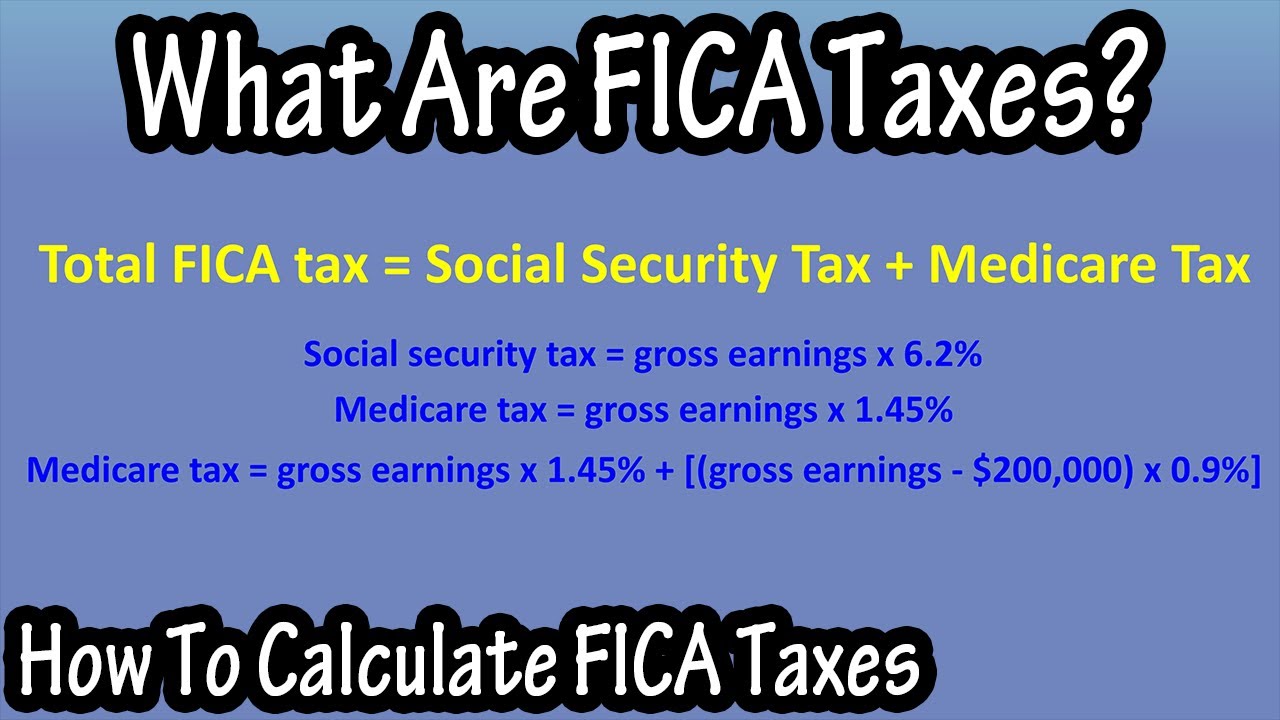

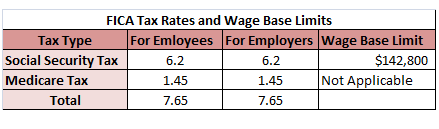

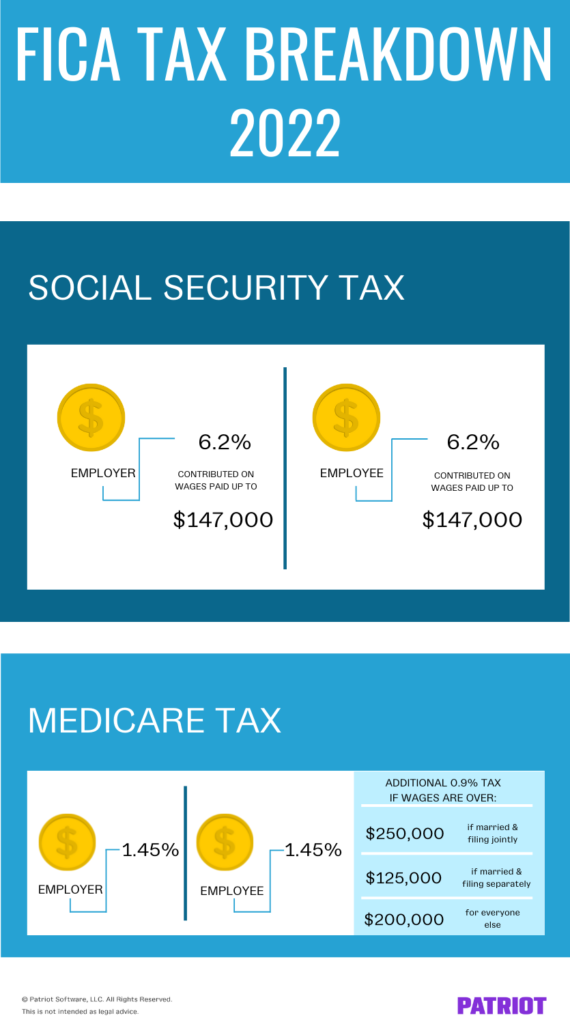

To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. Jan 15 2022 FICA taxes include both the Social Security Administration tax rate of 62 and the Medicare tax rate.

Fica Tax Guide 2021 Payroll Tax Rates Definition Smartasset

For example if an employees.

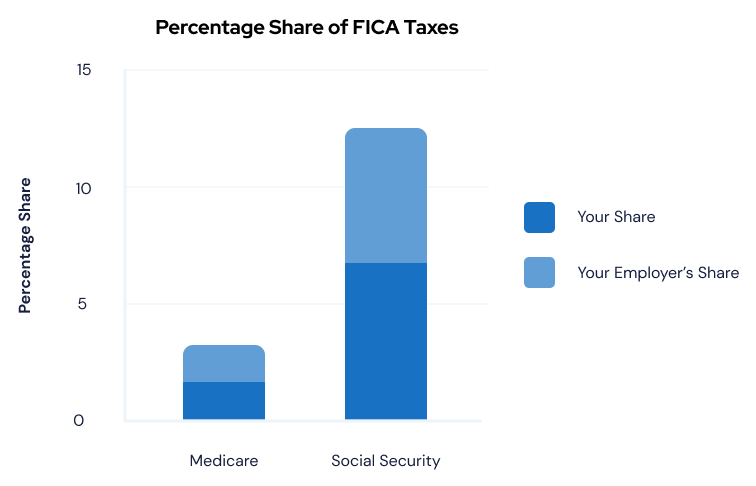

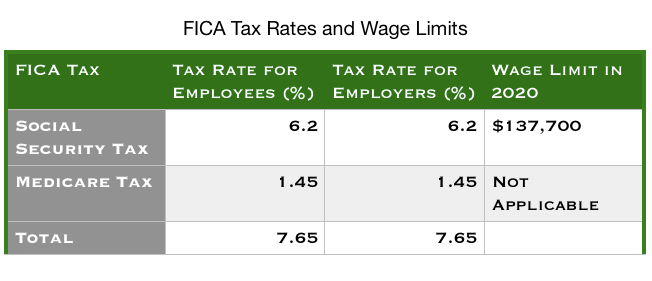

. FICA mandates that three separate taxes be withheld from an employees gross earnings. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Since the rates are the same.

26 2013 the IRS issued final regulations TD 9645 PDF implementing the Additional Medicare Tax as added by the Affordable Care Act ACA. 2 or 62 would be applied against the employers payroll tax for that cycle. The Additional Medicare Tax applies.

2 or 62 would be deducted from the employees gross earnings and would be filed with the IRS. For example Employer will deduct. To calculate FICA tax contribution for an employee multiply their gross pay by the Social Security and Medicare tax rates.

Here is a breakdown of these taxes. Our free online FICA Tax Calculator is a super easy tool that makes it easy to calculate FICA tax for both those who are an employee and those who are self employed. The aforesaid FICA tax calculator is based on the simple formula of multiplying the gross pay by the Social Security and Medicare tax rates.

FICA Tax Calculation. In addition to the Medicare Tax there is also the Net Investment Income Tax an individual or couple must pay if their respective incomes are over Adjustments to Net. Social Security Social Security is calculated by multiplying an employees taxable wages by 62.

The current rate for. For example if an employees. The total FICA tax is 153 based on an employees gross pay.

The Social Security portion of. Social Security and Medicare Withholding Rates. The maximum Social Security tax.

The employer and employee each pay 765. The employer and the employee each pay 765. Social Security and Medicare.

And so if youre. Thus the total FICA tax rate is 765. FICA is composed of two taxes.

62 Social Security tax withheld from the first 142800 an employee makes in. What the previous paragraph shows is that being self-employed is like being an employee but at a lower salary - lower by the FICA half that employers pay for their employees. The FICA withholding for the Medicare deduction is 145 while the Social Security withholding is 62.

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

2022 Federal Payroll Tax Rates Abacus Payroll

Medicare Tax In 2022 How Much Who Pays Why Its Mandatory

Fica Social Security Medicare Taxes Youtube

What Are Fica Taxes Forbes Advisor

What Is And How To Calculate Fica Taxes Explained Social Security Taxes And Medicare Taxes Youtube

Fica Tax 4 Steps To Calculating Fica Tax In 2022 Eddy

Easiest 2021 Fica Tax Calculator

Money Monday J 1 Exchange Visitors Social Security Withholding The J 1 Visa Explained

Fica Tax Video American Civics Khan Academy

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Overview Of Fica Tax Medicare Social Security

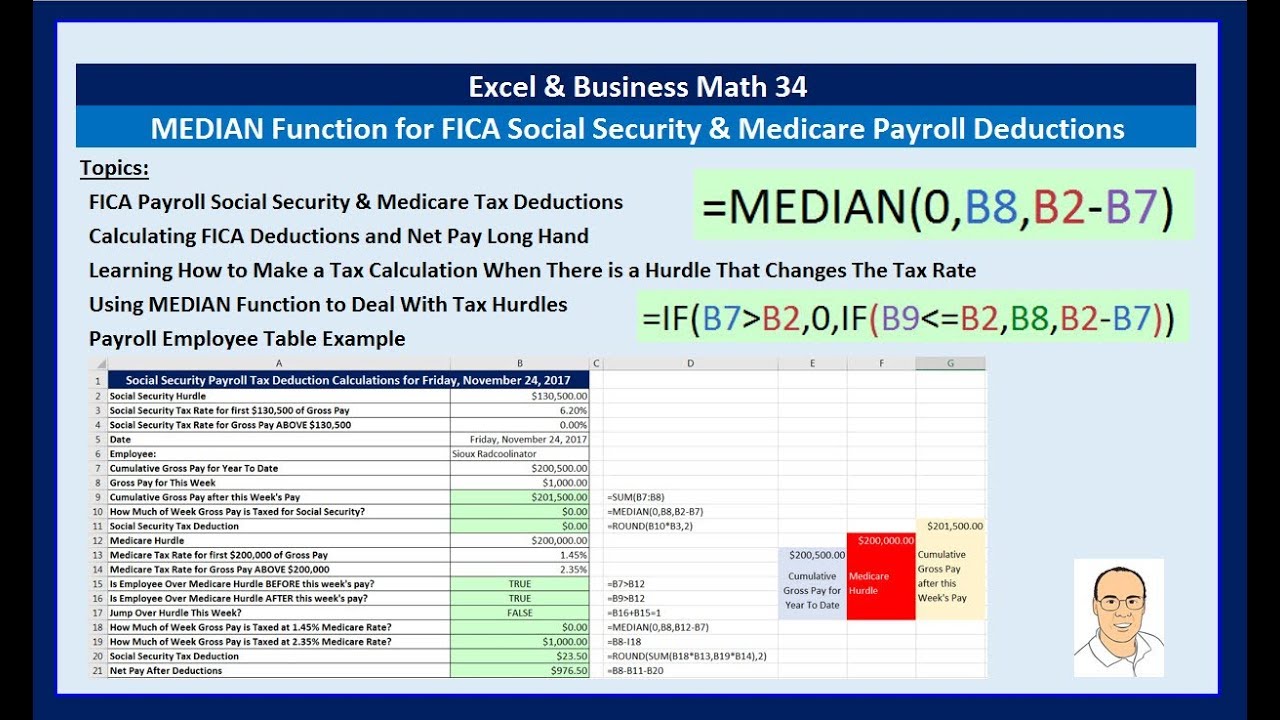

Excel Business Math 34 Median Function For Fica Social Security Medicare Payroll Deductions Youtube

Easiest 2021 Fica Tax Calculator

What Is Fica Tax Contribution Rates Examples

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

Wyoming Child Support Computation Form Net Income Calculation Form Child Support Supportive Net Income